The success story of UPI.

A Twitter user Mitul Gajera (username- @gajeramitulv) wrote an excellent thread on twitter explaining the success story of UPI and beautifully explained why the world should adopt it. Here is the thread-

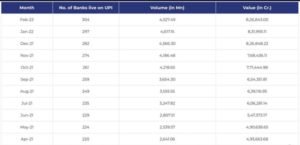

From 3 crore transaction value in August 2016 to monthly ₹ 8.26 lakh crore worth of transaction value in February 2022! How big is UPI and why the world should adopt it? The story of UPI.

Read somewhere: “India’s UPI is science fiction for the developed countries.” In 2011 on average only 6 were digital transactions per user. In the Past of banking system, users had to give “Direct Instructions” to banks to debit money.

Previously Bank name, IFSC code, account number were needed for digital transactions, or one had to do it via credit or debit card while doing transactions using a card, merchants have to pay a 2% charge to MasterCard or VISA.

Then came UPI. It works as an assistant to you and between your multiple bank accounts. It helps you to access all banks in one mobile application interface. It does not take any fees for any transaction and has 24×7 availability.

In 2019, Google proposed US federal reserve board the need to develop a UPI-like platform in the US after the success of the UPI in India and its tremendous growth.

UPI was started by NPCI(National Payments Corporation of India). NPCI conducted a pilot launch with 21 member banks on 11th April 2016 by Dr. Raghuram G Rajan, Governor, RBI at Mumbai. Banks have started to upload their UPI-enabled Apps on 25th August 2016.

UPI made payments simpler by removing the steps for entering Bank Account Numbers and IFSC codes. A user only needs the recipient’s “Virtual PaymentAddress” to conduct UP Based Payment which looks like “xyz@abcbank”

Under UPI third-party apps like phone pay, google pay, Paytm, and many other companies can collect transaction instructions from users and submit it to the user’s bank account.

There is dual-factor authentication so that transactions are secure. VPA (virtual payment address) is linked to the user’s mobile number as well as a bank and an easy KYC process was possible because 1.2 billion Indians have Aadhar cards.

Interesting numbers

• In Aug 2016 transaction value was only 3 crore

• • In April 2020 transaction value grew to 1.51 lakh crore INR

• In April 2021 – 4.93 lakh crore INR

• • In Feb 2022 – monthly 8.26 lakh crore INR transaction value!!

UPI registered dealings worth more than INR 73 Lakh Cr in CY21 — a year-on-year rise of over 110% as opposed to INR 33.87 Lakh Cr transaction in CY20.

When UPI started in April 2016, 21 banks were live on UPI, this number grew to 304 banks in February’22.

From the estimate, UPI will cross the $1 trillion mark! One of the reasons the number of digital transactions grew is the demonetization of 500 and 1000 notes in 2016 and UPI was launched in the same year to help India move towards a cashless economy.

“IPOs have played a huge role in attracting these users. Without UPI for IPOs, it wouldn’t have been possible for non-bank brokerage firms like us.” Nithin kamath

Now without the internet also UPI payments can be done.UPI’s success story has been a key instrument in the ‘Digital India’ initiative, with the homegrown payment gateway gaining success even overseas.

How or why the world should adopt it ?Globally, the payment system is dominated by a few payment processing giants and because of the network effect users are attracted to these giants.

They charge a huge fee for making transactions to merchants and for P2P payments.

Against this UPI is an open and interoperable platform where any bank registers themselves in the NPCI system and provides UPI service with zero transaction fee within a country.The biggest feature of UPI is interoperability. This means if you use an app like Paytm and your receiver is using google pay and both have different bank accounts then also by just scanning the receiver’s QR code or from their UPI ID, you can transfer money to their bank account from your wallet directly. Just scan QR code/ enter UPI ID/ enter mobile number, enter the amount, enter OTP, and done.

UPI frees you from all the hassles of entering a bank name, a bank account number, or IFSC code or going to a bank. After the success of UPI in India, NPCI is establishing UPI’s presence globally. In July, Bhutan became the first neighboring country to use the UPI platform for payments. In Singapore also UPI will be linked to their payment network PayNow starting from July 2022.

When it’s implemented, fund transfers can be made from India to Singapore using mobile phone numbers, and from Singapore to India using UPI with lower charges and fees. UPI payments are also available in UAE as NPCI’s global arm partner Mashreq Bank. Apart from these countries, UPI will be also available in Nepal, Malaysia, South Korea, and Japan by cross-border payment agreements and many more countries in the coming months as India is in talks with other governments. Currently, for international payment, SWIFT (Society for Worldwide Interbank Financial Telecommunication) is used as a global financial messaging to transfer funds from one country to another country’s user’s bank account.

Today, for International payments more than $5 trillion worth of transactions are done every day through SWIFT and the global average cost/ charge for sending money is around 6.5%. Recently, Russian banks have been cut off from SWIFT, even Mastercard and VISA have stopped their Russian operations. If the full world begins to accept UPI then this cost can be reduced. In the future, UPI might replace SWIFT if government promotes it through proper tech diplomacy then it will be the biggest financial revolution for India for international interoperable secure payments. It may take time but it’s possible.

This problem can be solved by Indian technology UPI which is already used by millions of people in India. India’s vision is to make 5 trillion economy by 2025, from UPI this gap might be filled. In this domain, other finance tech giants are behind and India can take advantage of it to become the world financial technology leader.

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.