Did you hear about solution of the President Biden to K growth?

Those of us who followed Presidential Debate 2020 would recall Joe Biden’s, as Presidential Candidate, description of the state of economic growth in USA in 2020 as K shaped.

President Trump had claimed V shaped growth. And Joe Biden strongly contested calling it K shaped.

The state of economic growth in the past in different parts of the world have been described variedly as U Shaped, V Shaped, W shaped, J shaped.

U shaped is very slow recovery after drastic fall. That is exactly what happened after 2007-09 Great Recession. The economic growth continued to be low till 2016, after drastic fall in 2007-09. The quantitative easing hardly did the magic. Magic Happened with President Trump’s Tax Cuts and Jobs Act, 2017. IRS then wrote, ‘This major tax legislation will affect individuals, businesses, tax exempt and government entities.’

The Tax Policy Center commented “The Tax Cut and Jobs Act (TCJA) reduced the top corporate income tax rate from 35 percent to 21 percent, bringing the US rate below the average for most other Organisation for Economic Co-operation and Development countries, and eliminated the graduated corporate rate schedule. TCJA also repealed the corporate alternative minimum tax.”

That gave a big boost to US economy creating U Shaped growth over 2007-2019. Americans found ‘We are Hiring’ hanging everywhere.

And then struck Coronavirus in 2020.

When Coronavirus struck, Coronavirus Aid, Relief and Economic Security Act, 2020 was promptly passed, providing $2 Trillion relief and stimulus. CNN summarized it as follows:

It was further supplemented in December 2020 by $900 billion. President wanted it more; particularly regretting that the relief to individuals was measly.

The Federal Reserve reduced the federal funds rate to nearly zero in 2020. The effective federal funds rate in 2020 have been nearly zero as shown below:

Source: https://fred.stlouisfed.org/series/FEDFUNDS

The net outcome has been that the stock market (S&P 500) had V shaped recovery.

Source: finance.yahoo.com

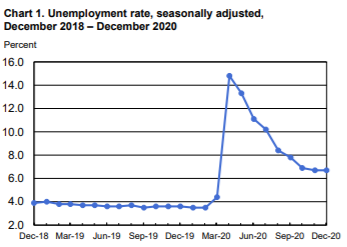

The unemployment rate had inverse V shape, as shown in Chart 1, meaning employment had V shaped recovery.

Source: https://www.bls.gov/news.release/pdf/empsit.pdf

Corona Vaccine became available in less than a year.

After President Biden taking over the office, Americans expect correcting K shaped would be his top priority. There has been no mention so far.

Let’s hope to hear strategy and plan for V shaped growth in USA. Indeed, that concerns every American.

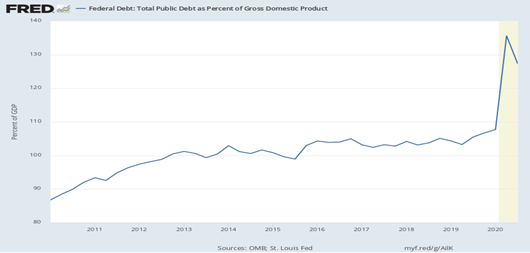

Source: https://fred.stlouisfed.org/series/GFDEGDQ188S

Reducing federal fund rates near zero in 2020 doesn’t give much promise as it was done earlier from 2008- 2015 without any remarkable results. Yellen, the new Treasury Secretary plans to raise more debt, in the current low interest environment, to help provide additional relief and stimulus. So, the downward shift of the curve depicting Total Public Debt as Percent of Gross Domestic Product, near top right side, in the above graph, looks pretty short lived. It is going to go up in 2021.

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.