What is OCEN and what does it mean for all of us ?

The introduction of the IndiaStack has led to paradigm-shifting changes in the Indian FinTech market, with disruptive innovations in the field of digital public infrastructure redefining what it means to conduct commerce, build products, networks , deliver and receive services over the Internet. Open APIs and protocols such as the UPI, BharatPay, FASTag, GSTN and eKYC are now paving the way for the next generation of public digital infrastructure goods and services, the most promising among which appears to be the Open Credit Enablement Network (OCEN) –

an initiative aiming to unbundle lending and create specialized entities for dispensing with different aspects of the lending process.

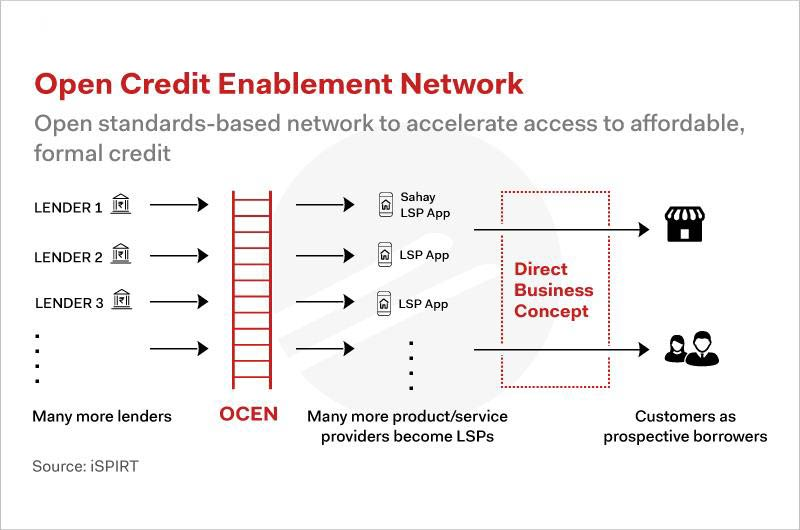

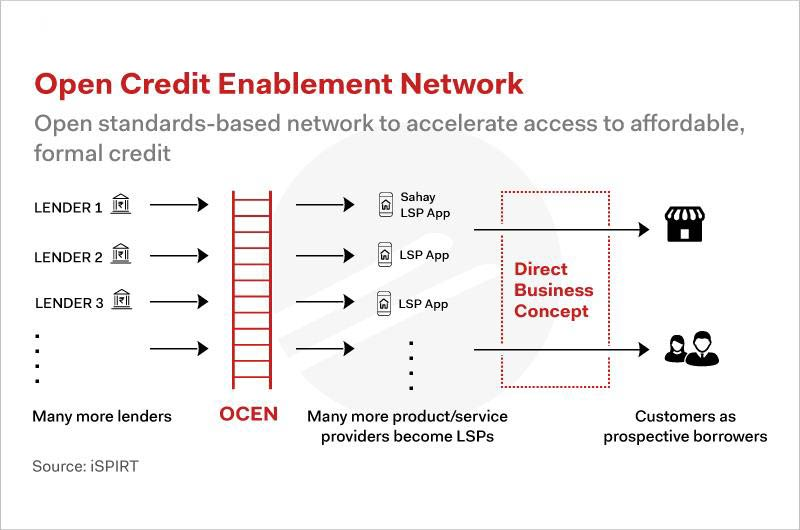

Launched in July 2020, OCEN acts as an open protocol infrastructure that acts as an intermediary between Loan Service Providers (LSPs) and mainstream lenders by providing a framework for APIs to aid the interaction between LSPs, lenders and account aggregators. By means of this framework of open APIs, OCEN would provide a toolkit to various components of the lending process – ensuring applications, marketplaces and account aggregators can add lending services to their repository of existing services.

In this new ecosystem powered by OCEN, several new roles and institutions are emerging in the credit and lending markets in India such as Account Aggregators ( expected to transform access to working capital credit for micro-enterprises), LSP (Lending Service Providers aiming to act as agents of borrowers, allowing them access to formal, affordable credit at low interest rates and collaborating with lenders to create more personalized options for borrowers), DEPA (Data Empowerment and Protection Architecture – a secure data-sharing framework to accelerate financial inclusion by establishing data-sharing protocols for Account Aggregators) and Derived Data Providers and Underwriting Modelers ( which provide analysis and credit scores by mapping insights generated from OCEN-extracted LSP data for use in the underwriting process). Various collectives have also been created and developed or are being partnered with in order to ensure streamlined delivery and deployment of the Open Credit Enablement Network such as Sahamati (a non-profit collective of account aggregators to operate the AA model across India) and CredAll ( a non-profit collective aimed to enable cash-flow lending by ensuring implementation of OCEN and providing access to the protocol to industry participants).

Currently, OCEN has been launched in the pilot phase, with its first rendition “Sahay”, partnering with leading financial institutions such State Bank Of India (SBI), HDFC Bank, ICICI Bank, Axis Bank among others, to implement invoice-discounting as the first use-case for OCEN protocol where merchants are able to draw credit against outstanding invoices. Upon its complete launch, OCEN will drastically increase the ease and efficiency with which MSME companies are able to draw credit, along with revolutionizing the space for innovative retail micro-lending products and services. Through widespread adoption of OCEN, its founding team and the Government of India hope to achieve their vision of having a billion people participate in the credit market. The open standards around which OCEN’s architecture have been constructed means that it is widely replicable across countries aiding them in their development models and will prove to be a major institutional framework for globalizing an international benchmark for wider participation in national credit markets.

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.