Why is best friend China scared of Pakistan’s destruction?

The difficulties of Pakistan, which are facing economic crisis and inflation, are increasing day by day. Import restrictions continue due to the balance of payments crisis caused by the shortage of foreign exchange. Pakistan is on the verge of default. China is also scared due to the fear of destruction of Pakistan.

Pakistan, which is in serious economic crisis, has the highest debt of China. To overcome this economic crisis, Pakistan is adopting one trick after another, but the situation is getting worse and worse. China is also worried in view of the deepening economic crisis in Pakistan and the possibilities of non-payment of foreign debt.

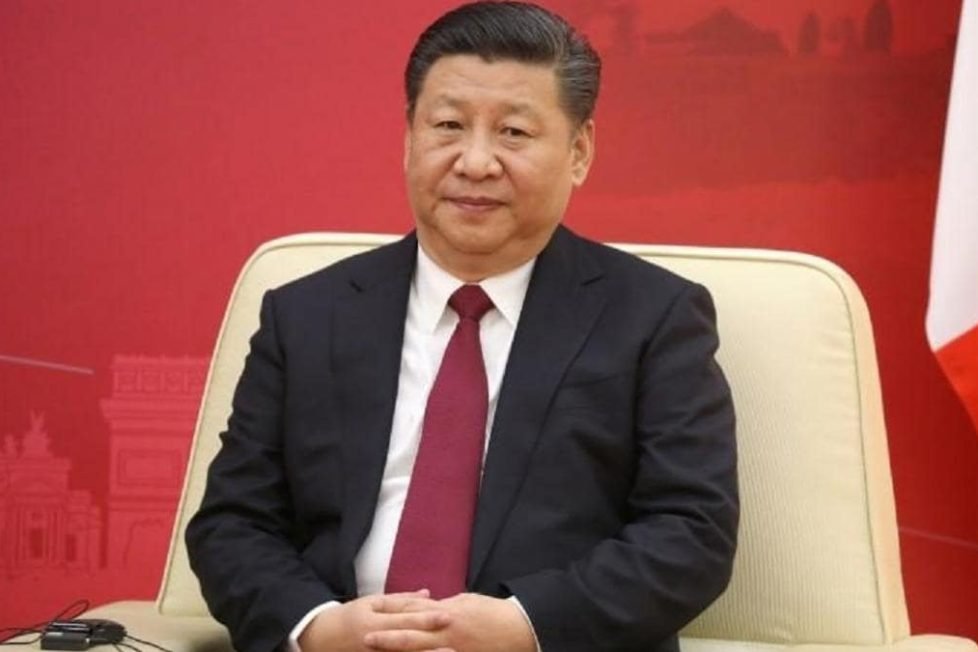

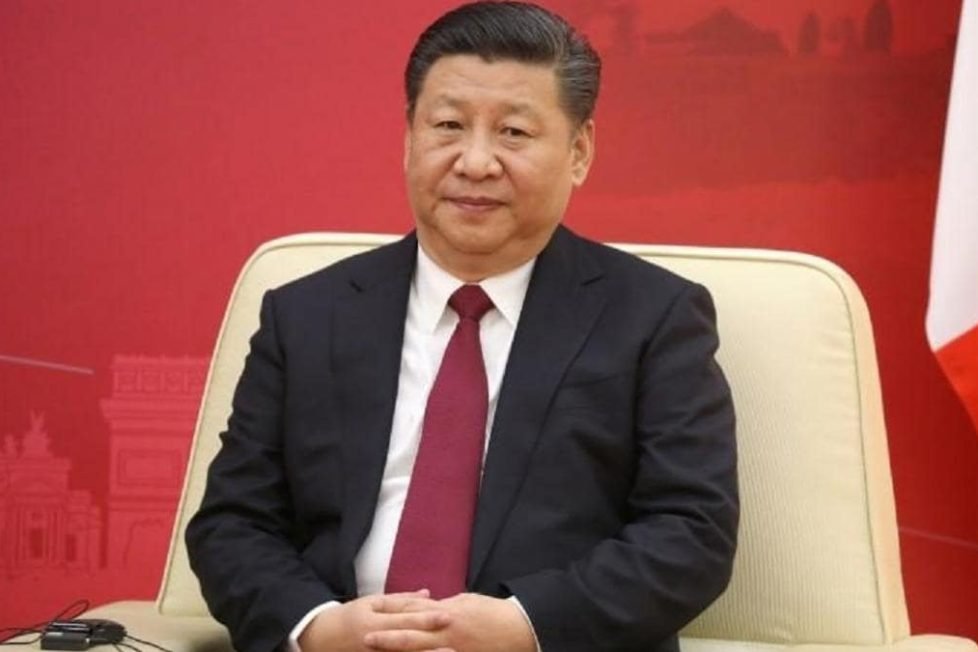

China has said on Monday that it supports the steps taken by Pakistan to deal with this serious economic crisis, hoping that Pakistan will overcome it and move forward.

Steep drop in current account deficit

According to Pakistani English newspaper ‘The Dawn’, according to the data released on Monday by the State Bank of Pakistan (SBP), due to the payment crisis, Pakistan’s current account deficit has fallen by almost 90 percent compared to January 2022 to $ 0.24 billion. only remains. Whereas in January 2022 this figure was $ 2.47 billion.

According to the report, compared to December 2022, the current account deficit for the month of January 2023 has also decreased by more than 16 percent. In December 2022, this figure was $ 0.29 billion.

Current account deficit means that when the total cost of goods and services purchased by a country exceeds the total cost of goods and services sold on its behalf.

Experts believe that China is worried about Pakistan’s economic crisis because the situation in Pakistan is going to be similar to Sri Lanka’s economic crisis.

Apart from this, the deep debt-ridden African countries also have a huge debt of China. Many of these countries have strongly criticized this loan. Even many people have demanded to write it off. In such a situation, China is fearing that this may slow down the pace of the country’s economy.

China has more than 30 percent debt

According to International Monetary Fund (IMF) data, out of Pakistan’s total foreign debt of US $ 126 billion, about US $ 30 billion is owed to China.

According to the report of Pakistani website Dawn, the total debt of China is more than three times the total debt of IMF. At the same time, it is more than the total debt of the World Bank and the Asian Development Bank.

Pakistan has defaulted: Pakistani minister

Pakistan’s Defense Minister Khawaja Asif made a shocking comment on Sunday, saying that Pakistan has already defaulted. The minister said that you must be feeling that Pakistan is going bankrupt i.e. default or meltdown is happening. But Pakistan has defaulted. We are living in a bankrupt country.

Responding to this comment by the Pakistani minister, the Chinese Foreign Ministry said that China sympathizes with Pakistan.

China issued a statement saying, “As an excellent strategic partner and friendly country, China sympathizes with Pakistan’s current difficulties and supports the measures taken to deal with them. China will continue to assist Pakistan and Will do all necessary cooperation for stability and sustainable development in the country.

We are confident that Pakistan will be able to overcome these difficulties and achieve economic and social development.”

China in trouble

Pakistan, which was suffering from cash crunch, was hoping that China would save it from being declared bankrupt like Sri Lanka. But China did not make any such announcement to help Pakistan.

China is already confused about how to help Sri Lanka. Because Sri Lanka has already defaulted on non-payment of foreign debt of US $ 51 billion. 20 percent of China’s debt is also included in this foreign debt.

After India, China has also written a letter to the IMF last month appealing for a bailout package of US $ 2.9 billion to Sri Lanka. However, even after this, it is difficult to say whether the money invested by China in Sri Lanka is safe or not.

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.