Analyzing Equity Investment & Portfolio Valuation.

World is truly global. The Economies of the different countries are interdependent and closely linked. Given such a scenario, analysing the capital market of any Economy has many facets. It is always the objective of the analyst which sets the boundary of such commentary.

Let us take the case of the Indian Economy with the perspective of an average Investor. Is an ordinary Indian investor who invests in the Indian Capital market or Mutual Fund industry happy? Yes, and should be, while the Indian equity market is hovering at the highest level in terms of Benchmark – Sensex & Nifty Numbers, we are pretty sure, valuation of existing portfolio must have offered all the necessary smiles.

Yet the worry lines do surface. And it appears when we examine the prospective return given the level of today’s valuation of the capital market. Let us look at present market valuation. Benchmark index at nearly all-time high zone and PE multiple (Price Earning Multiple) in a higher band then historical average. The PE multiple is an important indicator to assess the relative valuation of the capital market.

So, a curious investor should ask to know Why? While covid has tormented the world for nearly two years, the manufacturing consumptions and service data across the globe is struggling to retrieve previous best. Job loss and loss of revenue to the Government is emerging as new challenges to Fiscal managers of many nations. GDP in both absolute number and growth is struggling. Except for a few sectors like IT and Pharma, others have nearly poor stories to share.

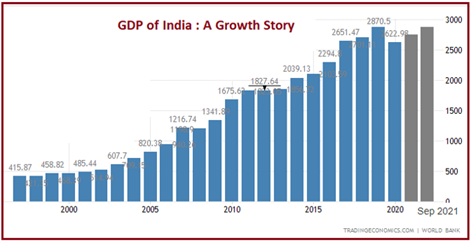

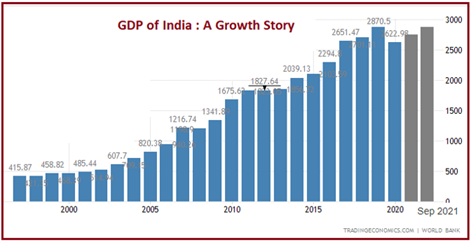

Yet Still Indian capital market and valuation is reasonably high? The graph below would probably display a revealing insight. While the world economy is visibly challenged on various parameters, Indians have outsmarted them. Our Growth numbers have been smarty retrieved. The collection of GST numbers on a month on month basis has complemented the economic activities.

Result, the Indian economy and capital market is pulling global resources. Developed nations at this stage have augmented the quantity of cheap money through lowered interest rates. And a part of this liquidity has flown into the Indian capital market unhindered. Yes, Liquidity always brings volatility. And hence investor worry at this stage is justified.

What next, if you are holding a Mutual fund portfolio, hold your belief in the fund manager investment skill and ability. Asset allocation, diversification, asset rebalancing, Rupee cost averaging and Value averaging are the guiding principles at this stage. Hold your nerve and control your investment biases. While the entire world trusts and participates in the Indian growth story, near term volatility and immediate valuation can distract you. This must now be understood. Discipline, trust and patience will remain key to an Investor success story.

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.