Market Volatility & Investor Prospective

While Indian equity market has displayed short term volatility but It has offered outstanding valuation gain over long period of time. And hence investor in Indian market had all the golden opportunity to make money.

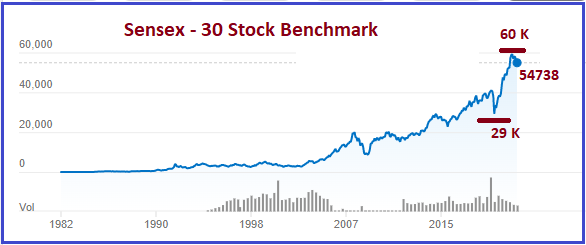

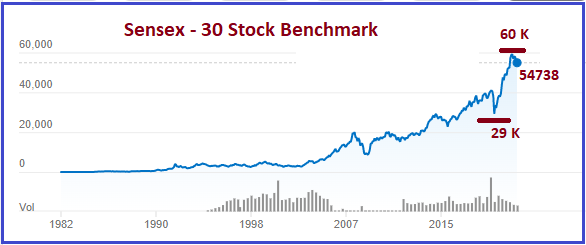

It is since the spread of Covid, Indian equity market has witnessed greater deal of volatility. The market which touched rock bottom 29000 in march 20 has leaped to all time high of 60,000 Sensex by Oct 21. Sensex is representation of market price of 30 Stock selected and maintained by BSE.

Market analyst are surprised and Investors are puzzled at this turnaround. What has driven this rapid rise in Sensex. Is it better covid management or better Growth prospect of our nation or huge liquidity?

Among the three-factor cited above, the Liquidity appears to be biggest driver of this Bull rally. Bull rally is popular word for rapid rise in sensex (Benchmark). From where is this liquidity is reaching to India. It is less domestic and more offshore. Yes, Western economy led by US has brought in huge quantity of cheap money by lowering their domestic interest rate. The cheaper money moved to India. The inflow was huge and sensex rally appears to be logical.

What next, West and US are now worried about their rising inflation. They are insinuating at the rise in domestic rate. Sone of the recent commentary by Central banker of respective nations are voicing on this line. The very recent Russia and Ukraine war has further brought inflationary trend into global focus. The oil price is rapidly rising. It is not an ordinary situation.

How will it impact Indian market and its present Valuation? For sure the liquidity driven bias of market will gradually taper. The withdrawal of liquidity would add to the market Volatility. And this is what we have been witnessing in near month. The depth of decline and quantum of volatility is unpredictable subject. A watchful mind can do better analysis.

How investor should react to such an extraordinary situation? We are certain about the market valuation which were on higher than historical average all this while. The moderation of valuation and decline in market appears logical. An investor at this point of time should relook and rebalance his portfolio. Rebalancing of portfolio is a skill. Either learn or ask your financial advisor to help you. One can never be sure about the valuation movement in a volatile market, but regular investment into portfolio and rebalancing of asset class ease the investment process. There are many an investment method and tools to learn for investor. Portfolio diversification and asset allocation is something which can discipline the investment habits.

Capital Markets offers opportunities, provided Investors are equipped to accept and execute those opportunities.

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.