The Dollar Empire and Retreat of America

The global events of recent years, culminating in the American withdrawal from Afghanistan – disgraceful as per some in media, has forced us to rethink the grand arch of global history as it is being remade. Here, I set out to recall and layout specific geopolitical happenings of the past 50 years that helped shape the world story leading up to the present, concentrating specially on the currency wars and economic side of things, starting with some startling events that happened in the August of 1971, that were barely noticed at the time but caused huge ripples globally over the decades, and specifically for the “West”.

On a Sunday morning on 15th August 1971, the then US President Richard Nixon came on television and announced the suspension of convertibility of US dollars into gold for foreign governments, thereby breaking the Bretton Woods agreement of 1944, and abruptly throwing the entire world into a Fiat currency regime, with no hard asset backing any of it globally, perhaps for the first time in recorded human history. This drastic step had to be taken as America was bleeding gold reserves and would have eventually defaulted as the foreign governments, specially the French whose banks had ground presence in Indochina, were redeeming these foreign dollars for gold, as US printed away to fund its failing war effort in Vietnam. Despite being such a major world event, at that time, it was barely noticed by the common people.

For a while, things went on as if nothing much had changed, except that more and more countries started reducing their dollar reserves, since they weren’t any longer backed by anything, they had no special role in conducting global trade over other major world currencies. These dumped dollars made their way back into US economy leading to roaring inflation in the 1970s. The American policymakers had to find a solution, and thus came the Petrodollar.

In 1974, after the OPEC embargo on US in the wake of its support to Israel, US cut a deal with Saudis. In return for guaranteeing its security, the Saudis agreed to accept only dollars for their oil, and recycle those petrodollars back into US as investments into US Treasuries thus becoming creditors to the US government financing their spending. Gradually, most of the OPEC was co-opted into this and cut similar deals. This ultimately strengthened dollars position as the dominant reserve currency of the world once again, because as an essential commodity for every nations energy needs, everybody needed oil and could only buy it in dollars. Thus, most of the non-American world was slowly pulled into this cycle of endlessly funding more and more of the American debt, because one of the best ways to secure your dollar reserves was by buying US treasuries.

This made the cost of debt/capital incredibly cheap in the US, as the world was an infinite pool to consume US Treasuries – which is basically US government debt, and someone or the other in the global market was always there who had a demand for it. A wave of US mega-corporations cropped up that suddenly had access to dirt cheap capital, when their banks were printing the global currency, beating out all competition globally, whether through lopsided competition or via outright buyouts utilizing their access to easy money, i.e., the global currency.

This entire Petrodollar scheme was given an uneasy nod by the continental European powers, not counting UK – whose bankers can be considered as ‘con’-joined twins of the New York bankers, in fact, sometimes looking upon the geopolitical events it isn’t quite clear which side of the Atlantic Anglo-Saxons are driving the other. But that is a topic for a whole other article. Europeans had a desperate security need, facing the threat of a communist Soviet takeover, having no capacity to defend themselves, they decided to carry on financing the US this way while US acted as the de-facto global police for them. They were also able to use this arrangement to redirect attention from their own defense spending to other social areas, specially post 1980s. But the European businesses took a lot of hit in the global market due to the domination of US corporations monopolizing markets. This was also the time US started to build contacts with China, known as ping-pong diplomacy culminating with Nixon’s visit to China in 1972, partially for geostrategic reasons against the Soviet Union in the backdrop of Sino-Soviet border war in 1969, but more so to create and tap another market for its relentless deluge of debt, like it had done earlier in East Asia. The implications of courting China would be seen in the later decades. The Soviet Union finally broke apart via a series of events between 1989 and 1991. There was a momentary Euphoria among the Western powers, it was perhaps the height of their global political domination, with not a single world power left on the globe challenging them, while all those who aligned with Soviets, including India, got sucked dry with the fall of a major trading partner and went bust.

With the fall of Soviets, Europe quickly realized there wasn’t much value in financing US via its reserve currency, which was its arch-competitor in the global market. The push for creating a Eurozone within the European Union saw a new concerted effort, discussions over which were going on since 60s but which was consistently being blocked by the UK. But, the new efforts finally resulted in the Maastricht Treaty in 1992 between 12 member states. Such a single currency, eliminated the need for any dollar denominated trade happening between them, when each had their own sovereign currencies and used the reserve currency to trade among them. This ultimately reduced the need for them to have more dollar reserves. Many of their neighboring countries too would swap some of their dollar reserves for Euro, thus having a knock on effect, as the Euro would gradually become a new and powerful choice in the world’s reserve currency portfolio, mostly cutting from the dollar’s share. The Americans never liked that idea, specially with their appetite for global financing of their debt increasing dramatically to push forward the economy, resulting in bubbles like the dot com bubble in late 90s. More closer US allies like UK and Sweden never joined the Eurozone citing many reasons. But still, it was a reality in 1999. Things quickly took another major turn with Saddam Hussein, who had a bad history with the Americans in the first Gulf War, deciding to trade Iraqi oil in Euros, something that the Americans always feared. In October 2000 Iraq insisted on dumping the US dollar – ‘the currency of the enemy’ – for the more multilateral euro.

Saddam knew that such a move would be a threat for stability of the American banking empire, as it broke the cardinal rule of not allowing oil trade in anything other than the dollars, which was one of the main pillars that kept its status as a global reserve safe. Saddam had reached out to United Nations and secured an approval for it. Just a month before US’ invasion of Iraq in March 2003 reports were aflush that Iraq had made a great gain by selling its oil in Euros, which had seen significant appreciation against the dollar. BNP Paribas was the French bank that was the facilitator of this Iraqi oil trade. BNP Paribas was separately fined billions of dollars under charges unrelated to Iraq, of doing business with US sanctioned entities. Such sanctions regime, enforced via the New York based SWIFT – the global financial transactions enabler, had become a common occurrence in the US geopolitical arsenal – often referred to as weaponizing of the dollar. But, it had an equally opposite reaction, pushing countries into trying to find a way out of this choke hold, and a search for alternatives.

While US was desperate to keep the existing system intact, and its own allies wanted to break free, another development that happened in Asia was the massive industrialization of China that was triggered by that original deal in the late 70s, and had gone on full throttle. American corporations that had access to world’s cheapest capital which was accepted globally, used that to engage the cheapest labor in China to out produce most competition. But, China wasn’t playing the straight game, and had no intentions of being an American lackey like the Taiwanese or the South Koreans, or even Japan. Not only did they steal a lot of the American intellectual property – if that can really be called stealing, given what the west had done in centuries past, but they also accumulated the highest amounts of Treasuries becoming the largest creditor to the debt guzzler US. The way US carries on with its humongous amounts of debt, is through a mechanism of rotation, as some of the previously issued Treasuries mature, they issue fresh ones to cover for them. China threatened, and still threatens, to simply stop recycling the more than a trillion dollars of American debt it holds back into the US bond market, potentially creating a sovereign debt crisis for US. The gulf countries too hold an unknown amount of US Treasuries that they accumulated under the petrodollar arrangement, and occasionally issue threats of their own. While these are indirect threats, there are some direct threats to the dollar system too.

Libya had one of the best gold reserves in Africa. Its ruling dictator Muammar Gaddafi wished to create a gold backed dinar, which he wanted the African Union to adopt for trading all of its oil in. Unfortunately, Gaddafi too fell to the US war machine and the country was utterly destroyed, and its gold evaporated into thin air. The real reasons why Gaddafi had to go came out in some media circles years later. Venezuelan leader Nicolas Maduro wanted to trade his oil, the largest reserves in the world, in non-dollar terms, preferably in a crypto currency he created called Petro. Venezuela is under some of the harshest sanctions regime. Same is the case for Iran, where apart from military threats, one of the main reasons of sanctioning Iran is to keep its non-dollar denominated oil out of the market. The European Union doesn’t like that and want the P5+1 deal back, as do the Chinese, who have openly defied the Americans. Russia opened its NordStream pipeline to Europe in 2010, over the next few years it has seen constant trouble on its border, resulting in physical confrontation with Ukraine, and sanctions by the US. But, European Union still backed the NordStream 2 which is on the last stages of completion, and they get to buy Russian gas, cheaply, and in Euros, which is the perfect deal for them as well as the Russians. It is clear that the EU and American interests don’t align, and have seen major rupture in the last 20 years.

The American petrodollar wars in the middle east, first in Iraq, then in Libya and Syria have left the EU to handle the humanitarian fallout. The 2008 Financial crisis, caused by the easy money floating in the US, leveraged by subprime borrowers, had a devastating impact in Europe whose banks were one of the biggest investors in this kind of American mortgage debt. When the UK had a Brexit, the end game was not just the exit of UK from EU, it was the shaking of confidence in the EU, and thus the Eurozone itself which is a subset of EU. It is not hard to notice the Anglo-American propaganda exhorting the debt ridden European economies to break free from the apparently German imposed austerity measures. On their part, Europeans have given complete backing to the climate change agenda – with the Paris accord, which is indirectly a way of getting away from the fossil fuel monopoly in the energy market – this isn’t liked by at least one section of US polity. Neither side wants to support the NATO now, as the American debt party is faltering, and Europeans don’t want to foot the bill to arm the US. That leads us to the current state of things, and the question – what now?

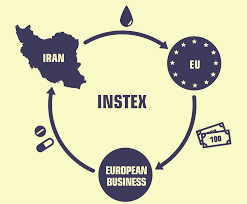

The Americans have a realization that the status of the reserve currency is not tenable. Russia is selling oil and gas to Europe in Euros, and dealing with China in Yuan. The Chinese, who are the largest oil buyers in the world are also buying the Iranian oil in a kind of barter deal, that doesn’t need dollar payments. Iranian and Venezuelan oil won’t remain off market for too long. The US debt levels have reached 125% of GDP, and once countries do more bilateral currency swaps, diversify into other basket of currencies, dollars fall will be even more spectacular. One big thing holding it together is TINA factor – There is No alternative – in a world of all around debasing currencies, its still backed by a stable nation state – which is increasingly appearing not so stable, internally. The talk around CBDCs(Central Bank Digital Currencies) is also a step towards global de-dollarization, a solution where a system like SWIFT may not even be needed to authenticate transactions. Europe has built an alternative to SWIFT, called the INSTEX, that they have created solely to circumvent Iranian sanctions, but have kept it on standby for wider global use, for now. Black Swans like Bitcoin, a blockchain based cryptocurrency created by an anonymous person(s) in 2009 after the Financial meltdown, too offer their own narrative as an alternative to gold or for global reserves, and for the death of dollar. Moreover, years of addiction to the dollar opium has led to over Financialization and structurally weakened the American economy. Most of the manufacturing has gone away, bringing down productivity substantially, and the large corporations and their owners – themselves institutional investors – can barely sustain 1-2% interests on their large debts. Even with runaway inflation, any tightening by the Federal Reserve will simply crash most of them. From an American viewpoint, its heading towards an ugly endgame unless something changes drastically.

In all of this, India has remained cautious and balanced, but has firmly aligned on the US’ side on a lot of the issues. It stopped oil trade with Iran – which was conveniently happening in Rupees. India had to turn down a lucrative Venezuelan offer for oil for American interests. The dollar reserves are exploding, accumulating a lot of American debt in Indian reserves. India sees value in becoming a hedge against China in Asia, and stands to gain by any diversification by American, and even European firms out of China, provided the domestic conditions are conducive. It can also get access to some cutting edge technology in defense, where the US is still the unparalleled leader. On the other hand, India keeps a strong relationship with France – which can be considered a strong and the most pro-Indian voice within the EU, while Germany is more balanced. India also went against the Americans on S400, and thus showed commitment to the Russians – though its not nearly enough to dent the growing Sino-Russian bonhomie. Russia is in a very cozy relationship with China, China needs energy that Russia sells, Russia needs finished goods that China has to offer, it’s much more than ant defense deals that India can make with them. As for China itself, it does take India seriously, and knows that the precarious prosperity it achieved is for the time being is dependent on keeping India as an option in the global story, out. Still, there was an effort by the nationalist government of Narendra Modi to have a direct dialogue with China and find common ground, but they were confident in their ability to keep India down via the irritant of Pakistan, or moreover, the political front for sale within India. Blocking the permanent membership of NSG, not acceding to a place for India on the Security Council, heat on the borders, among a host of others were actions by China that jeopardized any chances of a rapprochement of CCP’s China with nationalist India. Under such circumstances, and for a variety of other reasons that can be expanded upon separately, the best approach for India right now is to engage closely with the Anglo-Americans to counter China, specially when their chips down, while simultaneously working with the EU and Russians on strategic convergences as well. But, any deal with Anglo-Americans has to come with very strong pre-conditions – things that safeguard our national interests both internally and externally – otherwise its not really worth it.

One thing that is clear now is, that the old Western alliance, that shaped the post World War 2 era, is severely damaged, and may even be on its deathbed. As I write this, the latest geopolitical event has been the formation of a greater trilateral Anglo-alliance that includes US-UK and Australia that has cut out the French from a submarine deal, which has left the French and EU seething. But, the birth pangs of the New World Order are not yet over, many of the alliances have too many contradictions to sustain a stable global governance. The coming decade will eventually decide how it all settles into shape.

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.