Wuhan Virus Aftermath: US initiates Project “Choke China”

When the world's largest armed forces array themselves looking for a fight...what are they fighting over?

When the world's largest armed forces array themselves looking for a fight...what are they fighting over?

About a week ago, two aircraft carriers group, USS Ronald Reagan and the USS Nimitz, part of the US Seventh Fleet and each with their retinue of ships sailed into the South China Sea. Both carriers at over 1000 feet long, three times the length of a football field, displacing over 100,000 tonnes and each carrying more planes than many countries have in their airforce. A third carrier, USS Theodore Roosevelt is also stationed close at hand. Not just that, UK sent its newest aircraft carrier, HMS Queen Elizabeth, a slightly smaller carrier, to South China sea too.

What were they off to defend? Taiwan? But why? China has laid claim on Taiwan for a long while. The US has never acted as aggressively on it before. Yet, when one connects together the above with a string of other events, an interesting picture emerges.

Recently the US allowed the sale of 105 F35 Joint Strike Fighters to Japan. A deal which has been in the offing for a while now, but was propelled through recently. Australia had earlier committed to a 40% defence expenditure hike, spread over two decades, with all its investments aimed at containing China. On top of all this, yesterday, the UK parliament effectively shut out Chinese telecom giant Huawei from the country’s 5G projects and asked all telecom companies to uninstall Huawei equipment. Canada and US are soon to follow suit.

All of the above would seem like war-making moves. What triggers it? What will the fight be over?

The US had earlier stipulated that no US companies will supply chips to Huawei. Then again, on May 15, the US regulation required that any non-American chip producers, that use American chipmaking equipment must first obtain a special license to sell to Huawei. This has put Huawei’s future into a tailspin. Why? After all, China was racing towards self-sufficiency in all technological matters. Why would it be so stumped?

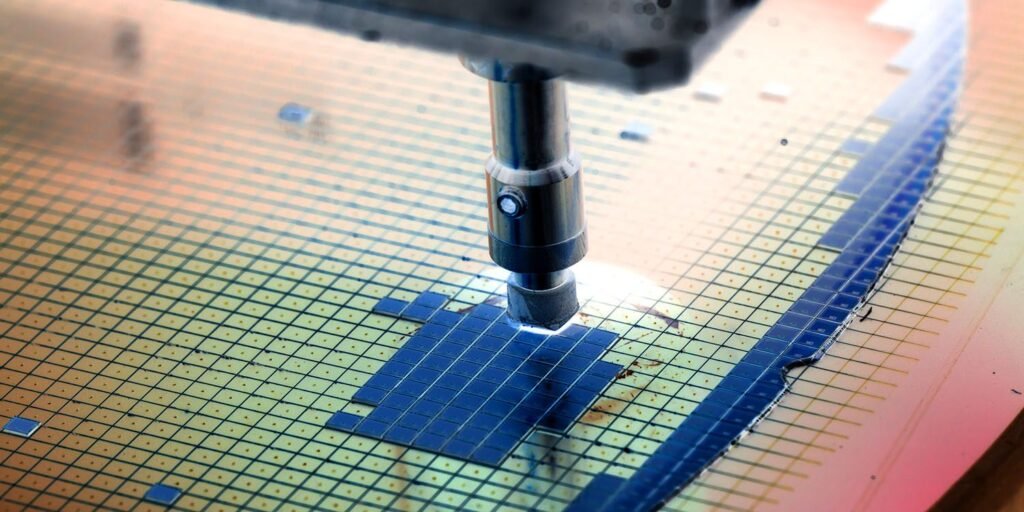

At the core of this unravelling geopolitical drama, that’s changing scripts by the hour, are semi-conductors a.k.a. chips. But not just any chip. Chips which measures less than five nanometers – about the width of two strands of DNA.

Semiconductor chips are the brains of all our electronics, from mobile phones to cars to fighter jets. The most advanced chips on the market today have billions of switches on them. The latest 3-nanometer semiconductors (N5P) being introduced by Taiwan Semiconductor Manufacturing Company (TSMC) will “feature the world’s highest transistor density and offer the fastest performance,” per a company release. In the 1970s, semiconductors housed approximately 3000 transistors.

Three major trends are defining the current geopolitical cold war between US and China. It pivots around the Future of Warfare.

These will not only be in next-generation war machines, from futuristic fighter aircraft like the FX program, that is to follow the F35, to warships, battle tanks, armoured vehicles to the equipment carried by the infantry, but will also be in drones and smart munitions, nano weapons and UAVs. All of these will be interconnected and all will be driven by automation powered by artificial intelligence.

These will be largely remote-controlled autonomous pieces of hardware embedded with the latest software with unbelievable power to locate, identify and destroy targets with amazing precision. Predictive capabilities of AI will enable strategists to be prepared and micro adjusted all the time.

Most importantly, all this hardware will have machine learning capabilities to constantly improve their performance. For instance, the latest fighter planes will be able to learn and adapt on the fly the dogfight techniques to outmanoeuvre an enemy aircraft by studying the opponent while in combat.

This machine learning capability will be far superior to that of a human pilot. A swarm of fighter drones will be remotely controlled by a digitally dexterous soldier or even AI. The armoured vehicle, taking on terrorists, will be unmanned and remotely operated. The superior ability to visualize the battlefield, enemy logistics, decide and respond will all be AI-driven and instantaneous. This is at the heart of the US’ $732 billion defence budget which is carrying out a digital transformation of the forces.

This requires an ability to transmit and receive a tremendous amount of data, process it, correlate, calculate, coordinate and instruct at the speed of light…almost.

Data may be the “oil” of the information economy, but without microelectronics, those data are just assortments of zeros and ones. Semiconductors, silicon-based “translators” of data into information, are essential to the 21st-century economy and warfare, making connectivity and all the resulting “information-related” innovations possible.

The artificial intelligence framework can be broadly characterized into three layers.

– The infrastructure layer includes the core AI chips and big data that support the sensing and cognitive computational capabilities of the technology layer.

– The technology layer sits on top of this. Which has machine learning, deep learning, AI platform, speech recognition, image recognition, biometric etc.

– The topmost layer is the application layer, which technologies in the second layer, uses to develop robotics, autonomous driving, business intelligence, smart factory, personal assistance, customer service, etc.

AI chips form the brain of the AI technology chain and are central to the processing of AI algorithms, particularly for deep neural networks (DNN). The U.S. leads the world in leading-edge semiconductor research, design and manufacturing. The Semiconductor Industry Association reckons that US companies accounted for about half of the $469 billion global semiconductor market in 2018.

This is China’s Achilles heel. It must depend on the US and Taiwan for semiconductors, and the US President Donald Trump is pinching China where it hurts the most.

Ultimately, semiconductor manufacturing equipment (SME), not chips, is key. SME is the “primary and most complex input” in the construction of fabrication facilities, accounting for about 80 per cent of construction costs. Today, three countries claim 90 per cent of SME global market share: the U.S., Japan and the Netherlands.

Late last year, the US after two years of pressure campaign persuaded the Netherlands government to block a $150 million sale of the most advanced Dutch chip manufacturing technology to a Chinese company.

Chip manufacturing is a highly capital-intensive operation and technological redundancies are extremely rapid. The industry is divided among “Foundries,” which make the heavy capital investments as manufacturers, and “Fab-less” semiconductor companies that design chips, but do not manufacture them, and avoid the high cost of fabrication facilities. The US leads the design while foundries are in and around the South China sea, in Korea, Japan and Taiwan. Currently, China imports over USD 200 billion worth of IC chips from the US, almost matching its total imports of crude oil.

THE MAGIC POTION MAKERS

TSMC, the US$38 billion Taiwanese company produces more than half the world’s annual supply of chips. The industry has been a diplomatic asset for Taiwan, entrenching the US and Chinese interests in Taiwan’s stability and autonomy. Taiwan has a dominant role in the international supply chain for these tiny but strategically vital products. Together with South Korea’s Samsung and Intel from the US, Taiwan is at the cutting edge of semiconductor technology.

All this while Taiwan and TSMC have avoided being caught in the Sino-US trade wars. But not this time, as the US President, slapped a ban on any company, anywhere in the world, which uses US technology from exporting to China. Being a foundry, TSMC relies on US designs and SME to make the semi-conductors and therefore is prevented from exporting to Huawei. This effectively cripples the Chinese telecom company from developing and servicing 5G technologies, because the TSMC semi-conductor is the brain of the technology that powers 5G. The earlier ban was only on US companies which had helped TSMC duck the regulations and continue to do business with Huawei and China.

Taiwan’s semiconductor industry has deep links to the United States. It took off in the 1970s and 1980s when Taipei was looking for a way out of an economic slump caused by the 1973 oil shock. A combination of industry policy and unlikely personal connections with leaders in the Radio Corporation of America saw a generation of Taiwanese engineers trained in the United States. Today, almost all major US technology firms have some presence in Taiwan. The US sources its most advanced chips for military hardware from TSMC. Taiwan is also the second-largest market for US semiconductor equipment.

A US Congressional Research Service report updated on November 2019 raised alarms around China’s ambition to dominate AI, and the semi-conductor industry – two vital pieces that will give it military and economic supremacy. The US has been aware of this strategy and has continuously tried to stop China from getting ahead in this field. In September 2017 President Trump, following the recommendation of the Committee on Foreign Investment in the United States (CFIUS), had blocked a Chinese firm from acquiring Lattice Semiconductor, a US company that manufactures chips that are a critical design element for AI technology.

The Future of Warfare will be an Algorithmic War, and the US is currently holding the aces by controlling the semiconductor industry. All three major global powers are readying themselves to dominate Artificial Intelligence, which will power the next-gen combat. On July 20, 2017, the Chinese government released a strategy to take the lead in AI by 2030. Less than two months later Vladimir Putin publicly announced Russia’s intent to pursue AI technologies, stating, “Whoever becomes the leader in this field will rule the world.” The US National Defense Strategy, released in January 2018, identified artificial intelligence as one of the key technologies that will “ensure the United States will be able to fight and win the wars of the future.”

As of now, China lags woefully in the semiconductor business, despite announcing plans worth billions of dollars. This business has a highly complex supply chain, cutting edge proprietary technologies, is extremely capital intensive and burdened with rapid redundancies. Vital pieces of this supply chain are controlled by the US, such as the chip manufacturing machines, the design, while Taiwan has a dominance in the foundry i.e. the putting together of the chip itself.

Countries like Japan and Korea also have capabilities in this business. All countries are either hostile or have uneasy relationships with China. The Chinese market is almost entirely dependent on foreign firms for microchips. Domestic production accounts for just nine per cent of China’s semiconductor consumption – leaving 91 per cent of China’s demand to be satisfied by imports, 56.2 per cent from the United States. Chinese chips have so far been able to achieve 14 nanometers while TSMC is currently at 5 nanometers going on to 3 nanometers. Thus giving it an unbeatable technological edge over China.

Yet semiconductor technology is vital to China’s manufacturing base and to China’s top exports that include smartphones, personal computers, and smart televisions. China’s continued dependence on US and foreign semiconductor technology has been a catalyst for Beijing to double down on policies to promote homegrown companies. China is throwing $150 billion to create its own capabilities in semiconductors. However, the issue is not money; but access to technology, talent and most importantly the design and machines that make the chip.

Some 30 new semiconductor facilities are either under construction or in the planning stages in China – more than any other country in the world. But even the most sophisticated fabricator in China must rely on licensing chip designs from foreign firms and on high-volume commercial production lines outside of China. And foreign firms still dominate niches in China’s semiconductor market such as microchip packaging and testing, semiconductor equipment, memory and AI chips, as well as contract microchip making. However, this grand plan to build its own design and fab plants will take at least three to five years. Till then it has no option but to depend on the US and Taiwan.

While earlier, Taiwan used to be just an ideological matter, it is now imperative for China to control. China needs the foundaries. Given the fact that the US has already agreed to ‘One China’, could China make a move on Taiwan, the way it has on HK, and present the world with a fait accompli? That might have well been a plan. A plan, which the US possibly came to know about. A plan for which it was sailing in its Aircraft Carrier but had to be recalled on account of a COVID outbreak. A plan for which China kept its barrels dry from COVID. A plan to stymie which, the US flew in its B1B bombers over the South China sea. It was possibly to distract China, from carrying out that plan, that a distraction was created at Ladakh, which set off tones of a second front for it and it had to divert resources to Tibet. Soon the typhoon season will set in. All hopes of a quick dash will be lost.

The US-China trade war is an outward exhibition of a far deeper war to gain supremacy in the Future Wars – The Algorithmic War, that will eventually happen. And the TSMC five-nanometer chip can make the difference between which nation will be the post-Covid superpower. The three-football field long aircraft carriers are simply ringfencing TSMC & Taiwan from China; they are protecting a chip that can well sit over a few strands of hair.

Welcome to the future!

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.