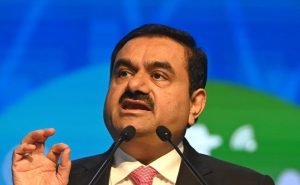

Why Hindenburg Report can prove to be a boon for Adani…?

Gautam Adani rose from a humble background to become the third richest man in the world, a feat that could not have happened by grace in the absence of exceptional business acumen. Well-known columnist Swaminathan S. Anklesaria Iyer has said in one of her columns. He said that Gautam Adani, the surveyor of the Adani Group, has been facing allegations that he was given valuable assets by the Bharatiya Janata Party (BJP), ranging from ports to mines, and from airports to transmission lines, but the fact is that the government What DDA had given to Adani in the initial phase was only a small port in the desert region of Kutch, where even rail connectivity did not exist. Converting this desert piece into India’s biggest port is nothing less than a miracle.

In an article published in the Economic Times, noted columnist Swaminathan S. Swaminathan S Anklesaria Aiyar writes, “The Hindenburg Research report alleges price rigging and fraud by Adani’s companies… These allegations are very serious… Due to this, global investors panicked and bought Adani. sold its shares… This should be thoroughly investigated, and the guilty should be punished… But I want to raise a different, but related issue… Adani’s critics say that Adani has Got rich not by skill but by monopoly achieved through manipulation and political favours… I disagree… It is impossible to become the third richest man in the world from a humble background in just two decades without exceptional business acumen.. .”

He writes, “I researched Gujarat’s new port-led development strategy in 2006, and wrote a paper for the Cato Institute… This strategy was launched in the early ’90s by Congress chief minister Chimanbhai Patel And then it was taken forward by BJP chief ministers… I visited Gautam Adani’s new Mundra port and was awestruck by the high level of automation and speed… I was also surprised to hear that the ships that dock here Entry is not given on time, and those who are unable to unload on time are given monetary compensation… When I was working in Mumbai in 1990, I saw ships waiting for 20 days to enter the port I had seen it being done, so I was feeling that Mundra Port is from some other planet…”

Swaminathan S. Anklesaria Iyer’s article further said, “Adani has acquired jetties and ports in a dozen other places by outbidding global giants such as Maersk and Dubai World in auctions… There is no port operator to match him in India.” which single-handedly handles one-fourth of the total cargo traffic in India… This makes them the front runner in India… And this is the reason why the Indian government has given Adani group strategic jetties and ports in Sri Lanka and Israel. What critics are calling a favor…is it really a favor…?Sri Lanka Terminal to cost US$750 million, Haifa Port to cost US$1180 million … No Indian rival would dare to take such a big risk, even if everything was served to him… So, Adani’s skill has made him not only a businessman.

Iyer writes, “It is not easy to monopolize a port…competition in terms of logistics as well as price has to be made to bring ships closer to established rivals…Mundra’s logistics have generated thousands of crores of rupees.” Has attracted investment, setting up this industrial hub in the desert… It has the world’s largest automated coal-handling facility… Adani Ports and Special Economic Zone (APSEZ) has been ranked as one of the global was ranked in the top 25 percent of port companies…”

Talking about Adani’s business acumen in an article published in Economic Times, Aiyar further writes, “Critics focus on government favors done to Adani… But business success in India is not just about good management of factories. , Politics also needs good management… All businessmen are close to politicians… It can only provide opportunities, or exemption from some rules, but it can’t guarantee success.. Anil Ambani is accused by (senior Congress leader) Rahul Gandhi of getting Rs 30,000 crore in defense deals, but Anil Ambani was a commercial flop…”

Comparing Gautam Adani to Reliance Group founder Dhirubhai Ambani, he further writes, “Once, Dhirubhai Ambani was also accused of political manipulation and fraud (boondoggle)… Then he replied, ‘I did it. What have you done, which every other businessman has not done…?’ No answer came from anywhere… Other businessmen, many of whom had the advantage of mazi, wooed politicians, and manipulated accounts… New entrants in the market, someone like Dhirubhai For him, to beat the giants at their own game was a sign of limitless talent… The same can be said about Adani…”

Iyer further writes, “Critics say that Adani works mainly in the field of infrastructure, where close ties with the government work more than skill and talent… It is not so… In the years 2003-08 Dozens of people with strong regional political clout entered during the beach infrastructure boom, but despite having political patrons, many of them ran into trouble, went bankrupt, and as a result owed banks huge amounts of money. were burdened by the non-payments… So, infrastructure requires skill and talent, political friends alone will not do…”

He writes, “Readers may consider me an Adani fan, but I do not own any Adani company shares because of the high prices and high risk involved… Adani has fetched very high prices at auctions raised from loans.” But they are expanding and expanding at a very fast pace by bidding and acquisitions… This allows rapid expansion, but also carries a lot of risk… The conglomerate expanded wildly to build a fortune, was successful for a few decades, earned accolades, but eventually failed (as did General Electric under Jack Welch…).

Terming the Hindenburg Report as a blessing in disguise, Swaminathan S. Anklesaria Iyer writes, “I think the Hindenburg report may be the best thing that has ever happened to Adani… It will slow down the pace of their expansion, and Adani’s financiers will need to be cautious and careful in future.” … It may impose financial discipline on Adani as well, which will benefit Adani only… May be, Hindenburg report will prove to be a blessing in disguise… And may be, one One day I will also buy shares of Adani…”

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.