If There is Nothing Free: What are Stimulus and Relief Payments?

For years, as student of finance, I have been reminded that there are no free lunches. When I landed up in U.S. some years back, I heard that in USA, there is certainly nothing free. You should not expect even a curse for you for free.

I then noticed that American actually love ‘free’ and even rebates and discounts, as those are great sources of instant gratification.

The US stock market celebrates stimulus and relief payments.

The second relief bill signed by President today is some $900 billion. The first known as CARES Act was $2.2 Trillion.

President delayed signing the bill this time for one reason. The stimulus payment of low income American Adult should be $2000, not $600 as provided in the Bill. $600 is measly. A sheer tokenism.

Congress has promised to look into it, and it is highly likely that relief for individuals will be raised to $2000.

The President- Elect said, it is a ‘down payment’; more is coming after Jan 20,2021.

First of all, ‘more is coming’ is not that simple. The two seats of the Senate to be filled early January 2021 will decide many things.

And even if coming, coming from where, is a relevant question.

As we all know, it comes from Federal Budget.

What is the state of the Federal Budget?

The budget could be surplus, balanced or deficit. Surplus means Income more than expenditure; balanced is where income and expenditure balance each other; and deficit is where expenditure is more than the income.

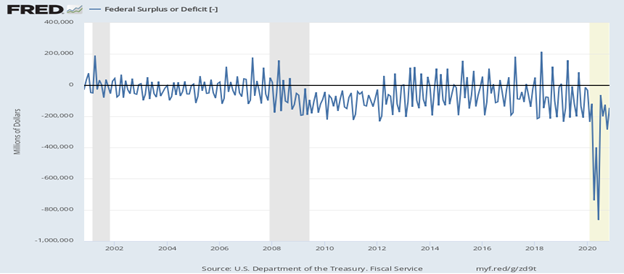

The graph below shows that US Budget, over 2000-2020 has been more often in deficit than balanced or surplus.

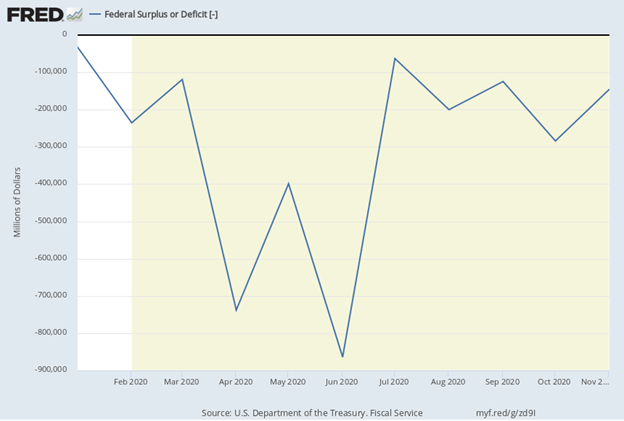

Here below is the State of US budget deficit from January- Nov 2020. You have not to be an economist to predict what will be the state of U.S. budget for the month of Dec 2020. And then in 2021, if this bill is really a ‘down payment’, as President- Elect says.

Indeed, thanks to the great economist Keynes who taught the world in 1935 that budget deficits or deficit financing is a great recipe to recover from economic downturns like Great Depression. Ever since that day, downturn or no downturn, budget deficit has become a normal practice all over the world.

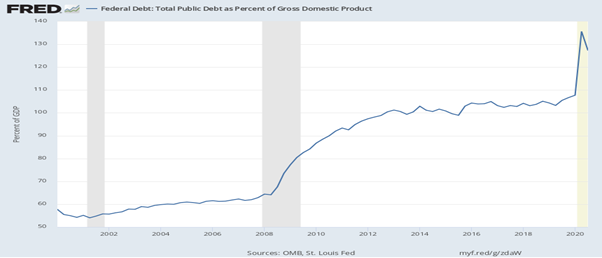

Deficit financing is essentially debt financing. So, what is the state of U.S. Debt. There could be diverse measures of debt. A popular relative measure is debt to GDP Percent. In terms of Debt to GDP Percent, the state of the U.S. debt is depicted in the graph below:

U.S was closer to 110% before COVID-19. After COVID-19, U.S have hit 135% also. And that little downturned line in the top right side of the graph is not only fragile but short lived.

Every citizen of America is now used to hearing time to time, ‘unless the President signs the bill, Government will stop’. But in the end the bill is signed, and Government doesn’t stop as it was today also. What that signing celebrates is more spending power to the Government. Today, they signed for $1.4 trillion spending. Some media pandits are pronouncing that President Trump has backtracked and signed $2.3 billion package. Please know relief is $900 billion. Rest is government spending.

You as a concerned citizen, may like to know what are the sources of income and uses (expenditure)? How far are the stimulus and relief payments the cause of the budget deficit?

The graph below shows the total Federal government expenditure over 2000-2020. Clearly, it has been on the rise and was in the vicinity of $8 trillion before COVID-19 and have shot up to touch $11 trillion post- COVID-19. Stimulus and relief added around $2.2 trillion till November. In December, it will add another $900 billion.

Who will foot the bill? Let’s take a look at the sources of revenue for the Government.

According to the graph below (Courtesy : Tax Policy Center), around 50 % of government revenue comes from Individual Income Tax. If you add excise, and other, on pro-rata basis, more than 50% come from individual citizens. Will the future be different? When the figures speak for themselves, you need not, and perhaps can’t, do anything except listening.

Let’s look forward to the final payment. But it is difficult to believe that it is all free.

Happy 2021!

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.