GST: RECENT ISSUES AND REFORMS REQUIRED

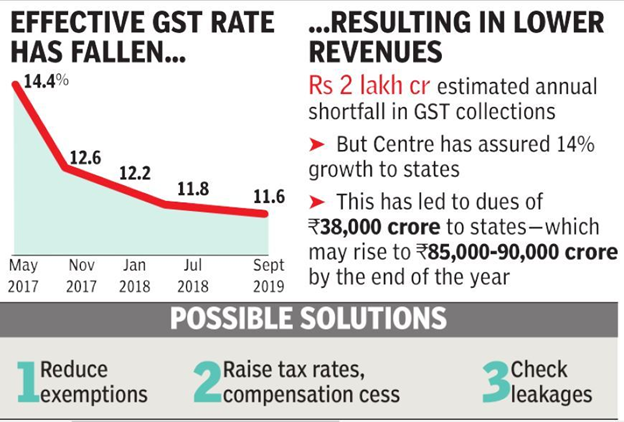

GST was a huge bargain when States gave up their rights to collect sales tax while the Centre gave up excise and service tax. Australia also shares the GST anniversary with us where the rates have been constant at 10%. Thus, a single rate in India can be a huge reform, and a matter of discussion too! But there is an urgent need for structural reforms in GST, in order to be a leading economy.