Twitter’s Shareholder Activism Situation

Recently, corporate ecosystem saw the rise of something called Shareholder Activism – a bunch of minority investors acting as activists to push their point through. This generally works in transition towards green technology, more spending on CSR and try to impose a biased ideology on the big picture. For good or bad, some companies are identified to sit in the activism model – those focussing on social good, those daring governments and spreading anarchy in the name of free speech etc. Look around you. There are some major companies which have picked the activist mode – some companies where the majority stakeholders themselves are activists.

The primary focus of these activists is what is known as ESG movement – activism in Environmental, Social and Governance matters. Soukup, in “The Dictatorship of Woke Capital” synopsizes it as

Why, the utopian investor asks, should we measure the success of a company exclusively in terms of the number of smartphones it sells every quarter, multiplied by the cost of a smartphone, minus the costs associated with making and distributing those smartphones? Why shouldn’t we define success to include our beliefs and our values? Why shouldn’t we add another variable to the equation, one that measures the “footprint” associated with the manufacture and distribution of the smartphones? Why shouldn’t we demand—given the power our control of capital grants us—that our values be reflected in the investment of that capital? Why shouldn’t we insist that our values—religious in nature and unpopular in the voting booths—be the standard for participation in our system?

Further on, he notes(emphasis mine),

On June 19, Tom Cotton, the Republican junior senator from Arkansas, took to the floor of the Senate to decry political activism on the part of American businesses. According to Cotton, “liberal” CEOs were using their companies to attack and undermine the will of the American people in various localities around the country, and he, for one, had had enough of it.

“[T]his is a democracy,” the senator intoned, “so not everyone agrees…. We resolve our differences and reach compromises through democratic debate. What should never happen is billion-dollar corporations trying to dictate these moral questions to us.”

What had caught the senator’s attention—and raised his ire—was a concerted effort on the part of several multibillion-dollar companies trying to do just that: dictate moral matters to the American people. Specifically, several large media companies—“Disney, Netflix, and Warner Media”—had begun a campaign to punish the people of Georgia by crippling the state’s economy. Why? Because the elected representatives of the people had passed a law—in keeping with the values and beliefs of the state’s residents—to restrict abortion after a fetal heartbeat could be detected. These mega-media corporations were unhappy with the law, so they were threatening to pull production of their projects from the state. It was blackmail pure and simple. Pulling business from Georgia would serve only to hurt Georgians, including, of course, many women. But the media companies had their principles—or had, more likely, been told by activist employees and shareholders what their positions should be—and they were determined to make a stand, a blatantly undemocratic and coercive stand.

As Senator Cotton also noted, about the same time, the CEOs of “hundreds of companies” signed a full-page ad in the New York Times, insisting that abortion restrictions like the ones enacted in Georgia were “bad for business.” How, Cotton wondered, could protecting the lives of future customers possibly be bad for business?

Cotton complained that “as liberal activists have lost control of the judiciary, they have turned to a different hub of power to impose their views on the rest of the country.” He was right, of course, and he succinctly identified the entire point of shareholder activism. But he didn’t know the half of it.

What Cotton had stumbled upon was the burgeoning “dictatorship of woke capital,” the title that the editors of First Things gave his righteous speech from the Senate floor. He had stumbled upon the outward signs of the ESG movement and the soon-to-be-unveiled “redefinition of the purpose of a corporation.” In short, he had stumbled upon the effort of the political Left to harness the power of business, and especially capital markets, to advance overtly and exclusively political ends. There is no plausible fiduciary reason to claim that abortion restrictions/protection for the unborn is “bad for business.” That was simply the language that the activists, the corporate executives, and their PR specialists had decided would allow them to play the victim and demand that democratically elected legislatures and governors change the democratically approved legislation that they had enacted. It was mere cover—and poor cover at that.

The problem was that the woke capitalists lost their temper. And when they did, they forgot what they were doing and why they had previously been doing it so surreptitiously. They forgot that their effort was supposed to be carried out stealthily, without raising the ire of the likes of Senator Cotton and without attracting the attention of Americans who did not share their beliefs about abortion. They forgot that most Americans are willing to accept and, frankly, ignore high-minded vagaries about “sustainability” and favoring “stakeholders” over pure profit, but are unwilling to ignore solid, concrete attacks on their personal beliefs and their right to advocate for them in the public square. For the first time in a long time, the woke capitalists found themselves confronted with a popular movement that was not just willing but also able to cut to the heart of their positive-rights–laden ethos. And in response, they overstepped, awakening a nascent but nonetheless furious resistance. They blew their cover and, in the process, revealed the dark underbelly of their effort to transform American business precisely as they had transformed every other institution of Western culture.

This is but an example. Look at how some of such activist companies like Twitter are daring the governments of the world by refusing to clamp down on hate in the name of free speech. Twitter’s tiff with India on compliance with local law is but a famous such example.

Through its actions and deliberate defiance, Twitter seeks to undermine India’s legal system…Furthermore, Twitter refuses to comply with those very regulations in the Intermediary Guidelines on the basis of which it is claiming a safe harbour protection from any criminal liability in India…Twitter Inc, a USA-based private company, in its communique says that it seeks ‘constructive dialogue’, ‘collaborative approach’ from the government of a sovereign democratic republic to ‘safeguard interests of the public’. It is time that Twitter disabuses itself of this grandiosity and comply with the laws of India.

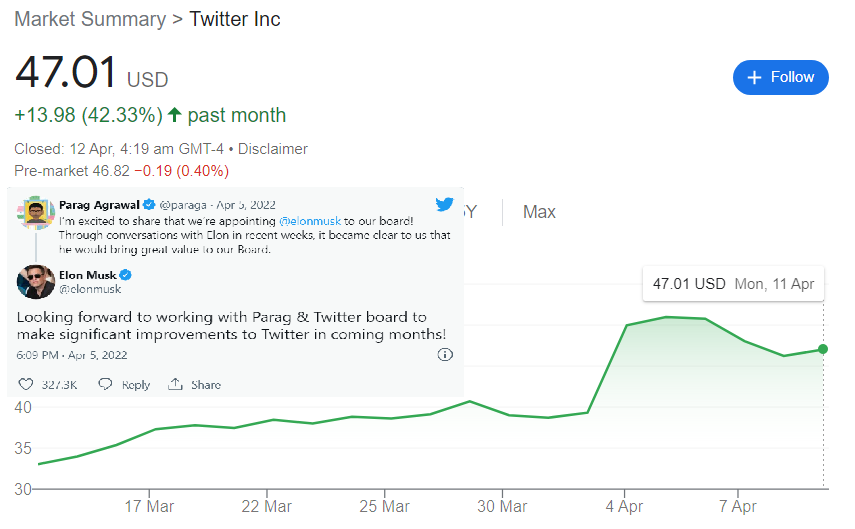

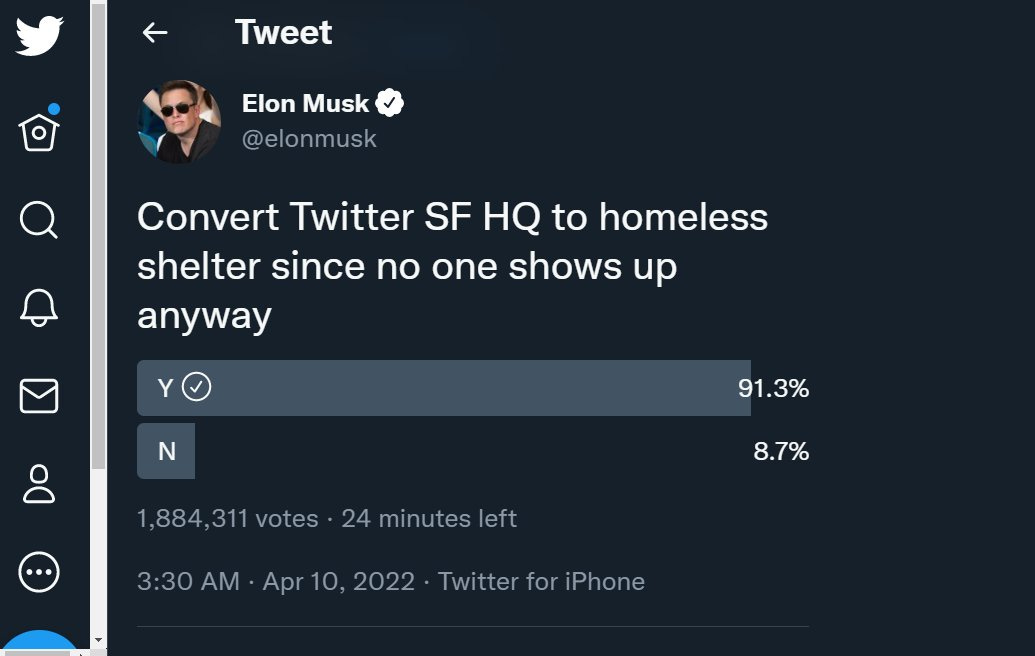

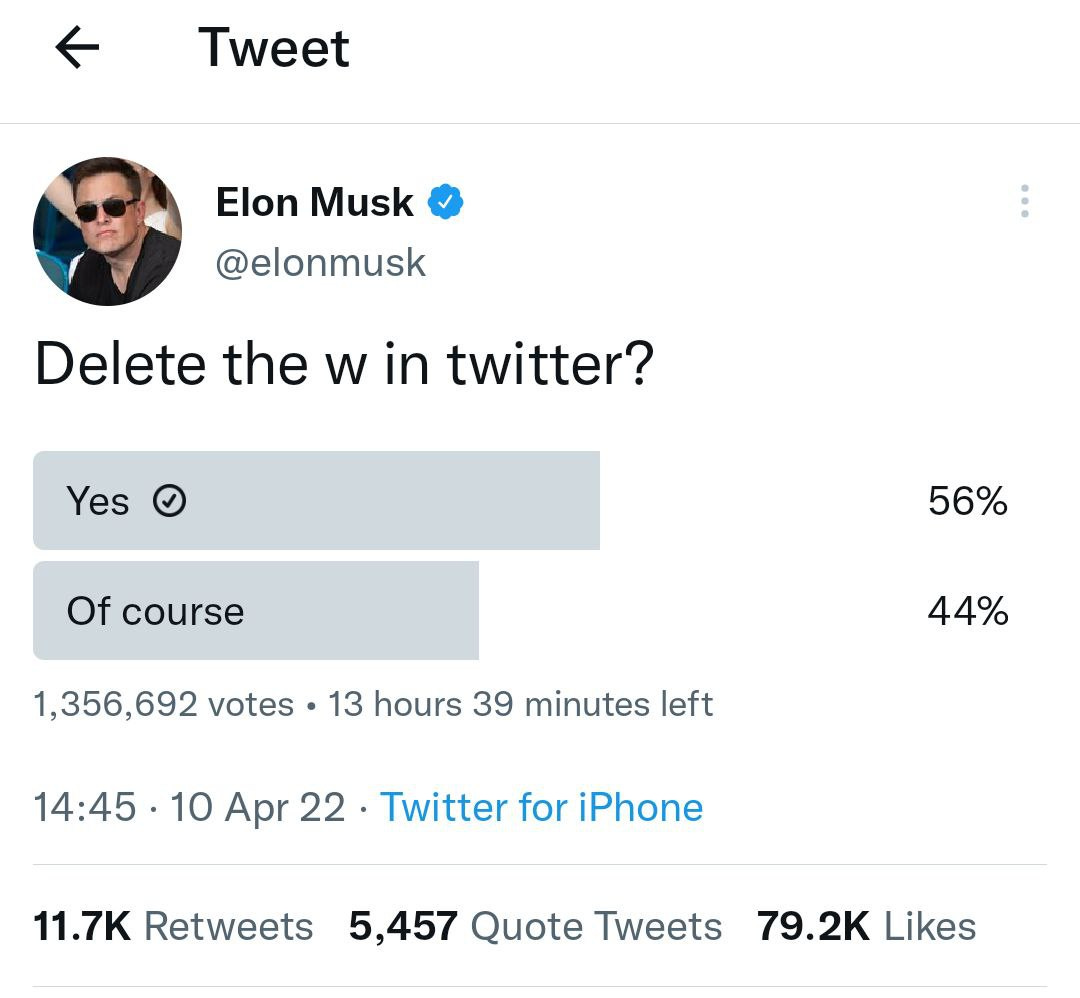

In this backdrop, it gets interesting when one notices that if shareholder activism comes to bite such a company – Elon Musk’s entry into Twitter hints at such. To be fair, he has already come up with multiple suggestions(though in an activist mode) to make Twitter better and more profitable.

On increasing traffic.

On conversion of an exclusive margin sales model to a volume sales model with high traffic.

However, some of his comments were unpalatable to those controlling the company.

Soon after, two things happened in quick succession.

And yes. A struggle is already being seen and there are concerns already over what’s going to happen.

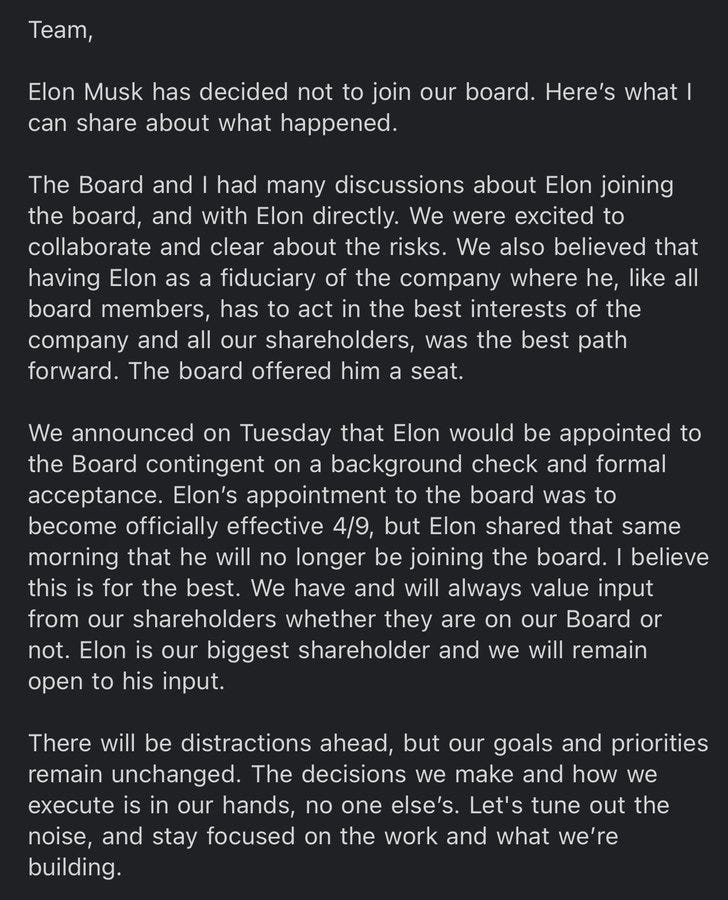

In a note to the company, the CEO Parag Agrawal wrote,

All this makes one wonder what’s in store for Twitter now. More importantly, the bigger question would be, what will happen when conservatives become Shareholder Activists undermining the ESG ecosystem and challenge their extra-judicial grip on the narrative?

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.