Germany risks recession as Russian gas crisis deepens, government urges citizens to reduce use

Natural gas arguably is Russia’s most important energy asset in the geopolitical scramble following the invasion of Ukraine. While the EU and other western allies agreed on an embargo on Russian coal and a far-reaching halt to oil deliveries, a ban on natural gas imports has been rejected by the bloc, despite numerous calls to implement it. Several member states, including heavyweights such as Germany and Italy, say they are too reliant on gas to cope with a sudden stop of supplies given that replacing Russian pipeline gas in the short term is much more difficult than finding alternative sources for coal and oil. Therefore, a collapse of gas trading with Russia would entail severe consequences for European economies. The Russian government already announced an end to gas deliveries to a range of countries, forcing Germany and the EU to prepare for a sudden supply cut. This factsheet explains why and when gas deliveries could be stopped, the immediate and long-term effects, and what precautions Germany and the EU have already taken. It also lists experts to talk to as well as important documents for journalists covering this story.

On 30 March 2022, the German Federal Ministry for Economic Affairs and Climate Action declared an early warning level for it to implement a gas emergency plan in response to Russian threats to cut off gas supplies to European countries. As part of the contingency measures, the German government could bring idled lignite power plants back online.

The early warning level is the first of three contingency levels that allow the government to set up a crisis team to monitor and assess a potential disruption to gas supplies. If the third and most severe emergency level is declared, the government would be allowed to take over as the national energy supply coordinator and activate power plants that are part of the national fossil fuel reserve.

On 8 June, the government passed legislation to enlarge its coal power plant reserve, according to Handelsblatt.

“This means that the short-term use of coal-fired plants in the electricity sector is made possible on demand, should the need arise,” said the emergency decree, according to Bloomberg, which saw the unpublished legislation before it was voted on.

Germany currently has 1,886MW of lignite capacity in its fossil fuel reserve, which is more than 10% of the country’s operational lignite capacity. Some of these plants were set to close permanently as part of the country’s coal phase-out, but if an emergency is declared their closure could be delayed for two more years.

The German government announced in May 2022 that the country had already reduced its dependence on Russian gas from 55% to 35%. If 35% of operational gas capacity is fed by Russian pipelines, then Germany’s lignite reserves could cover approximately 20% of Russian gas supplies.

Russia and its key gas customers in Europe both insisted initially that gas trading will not be blocked by sanctions or other war-related measures, despite repeated calls from western allies to pull the plug on one of Moscow’s most important sources of income. However, Russia’s demand in March that gas shipments be paid in Russian roubles alarmed western importers, as it showed that the Russian government was ready to use natural gas as a tool to influence EU policymakers. In a joint G7 statement, leading EU governments said they would not accept a change to existing contracts that stipulate other currencies.

As of mid-June 2022, Russia had cut gas deliveries to several European countries — for example Poland, Bulgaria, the Netherlands and Finland — citing a failure to comply with rouble payments in each case. Bigger EU customers like Germany and Italy so far have not been cut off, even though Russia refused to accept payments in euros from a German customer in at least one instance. In May, the EU softened its stance on gas trading restrictions, leading several key customers to ultimately cave in to Russian demands and pay in roubles. This concession could keep European gas customers’ supply stable in the short run. Germany has aimed to wean itself off Russian supplies almost entirely by 2024.

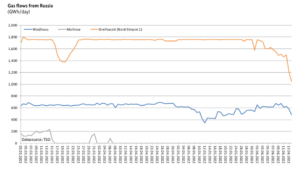

However, state-owned Russian gas provider Gazprom in mide-June announced gas flows from Russia to Germany through the key pipeline Nord Stream would be reduced by about 60 percent, arguing that German engineering company Siemens had failed to provide the equipment needed to carry out repairs. The announcement came just weeks before the offshore pipeline is scheduled to undergo its annual maintenance work, and Gazprom did not specify how long flows will be reduced. German economy minister Robert Habeck, who already in May said Russia would “weaponise” its fossil fuel resources, called Gapzrom’s decision “political,” as no technical or legal reason for the delay could be found. Habeck said the government might regulate gas retailing if the reduced flows mean gas storages cannot be filled according to plan.

According to Germany’s Federal Network Agency (BNetzA), the planned shutdown implies that the country’s gas storages cannot be filled further for the first time since the war broke out. The operator company said the pipeline will not be available between 11 and 21 July. Depending on the course of the war and the course of mutual sanctions between western countries and Russia, a halt to supplies thus may occur before storages can be filled sufficiently before winter.

Natural gas accounted for nearly 27 percent of Germany’s total energy consumption in 2021, mostly for heating and industry purposes and to a much lower extent (around 15%) for electricity production. Germany managed to quickly reduce its dependence on Russian gas since the invasion, from around 55 percent in February to around 35 in May 2022. However, it still faces the significant challenge of replacing the remaining share with alternative sources. As of mid-June 2022, the country’s gas storages were filled to 55 percent of capacity. A new law obliges storage operators to fill their facilities to at least 90 percent of capacity by November and retain at least 40 percent by February.

If Russia cuts deliveries through Nord Stream 1, authorities in Germany would have up to 24 hours to detect that the pipeline is running empty, network agency head Klaus Müller said. The immediate reaction on the German side would depend on consumption levels when the supply gets cut off; on filling levels of Germany’s gas storages; and on available substitutes from other countries, he said. Whether or not Germany will have to declare a state of emergency would then have to be decided quickly to prevent market turmoil, Müller said. An end to deliveries during winter could thus lead to greater difficulties than in summer, when gas consumption is much lower.

In the event of a severe gas crisis, so-called “protected customers” will be treated with priority if gas rationing is enforced. These include households, small businesses like bakeries, supermarkets, and essential social services, such as hospitals, schools, police stations or food producers. Companies with so-called “interruptible contracts“ would be the first to see their gas supply cut if rationing is enforced, followed by gas power plants that are not essential for grid stability. Next in line are large industrial customers, which accounted for about 37 percent of the country’s gas demand in 2021.

However, BNetzA head Müller said there is a wide range of factors at play depending on the gas cut’s exact circumstances, which makes establishing a clear shutdown schedule beforehand a very challenging task. “Unfortunately, it’s not possible to bring all these criteria in a clear-cut order,” he argued. Decisions ultimately would have to be taken on a case-by-case basis, “since the situation that prevails will be a rather individual one,” meaning the exact conditions of a gas cut are not previously known. Establishing an “abstract cutoff order” would not be possible even if market actors are calling for it to have greater planning security.

Production cuts due to gas shortages could disproportionately affect producers of energy-intensive basic materials like chemicals, steel, fertilisers or glass. Some industrial installations would be permanently damaged if they have to be turned off for an extended period of time. Company leaders have therefore warned against “dramatic” consequences of a domino effect in supply chains that could set in if their products are no longer available. This, they argue, would spread the damage across the economy.

What could be the long-term effects of a cut?

In a joint analysis of the country’s economic prospects in the energy crisis, Germany’s leading economic research institutes said halting deliveries would “threaten to throw the German economy in a severe recession.” A gas cut could reduce gross domestic product (GDP) by nearly one percentage point, from 2.7 percent expected in 2022 to 1.9 percent. In their previous analysis in autumn 2021, before Russia’s invasion started and the energy crisis gained full steam, the researchers still expected GDP to grow by 4.8 percent. For 2023, a gas cut could even lead to economic contraction of more than 2 percent, while a scenario with continued gas trading predicts GDP growth in excess of 3 percent. The cumulative loss of GDP of an end to gas deliveries could amount to 220 billion euros by the end of next year, roughly 6.5 percent of Germany’s annual economic output.

Germany faces certain recession if already faltering Russian gas supplies completely stop, an industry body warned on Tuesday, as Italy said it would consider offering financial backing to help companies refill gas storage to avoid a deeper crisis in winter. European Union states from the Baltic Sea in the north to the Adriatic in the south have outlined measures to cope with a supply crisis after Russia’s invasion of Ukraine put energy at the heart of an economic battle between Moscow and the West.

The EU relied on Russia for as much as 40% of its gas needs before the war – rising to 55% for Germany – leaving a huge gap to fill in an already tight global gas market. Some countries have temporarily reversed plans to shut coal power plants in response. Germany’s BDI industry association slashed its economic growth forecast for 2022 on Tuesday to 1.5%, revising it down from 3.5% expected before the war. It said a halt in Russian gas deliveries would make recession inevitable.

There are signs of supply disruptions in the coming days to Germany, Russia’s biggest customer of natural gas. The reason for this is to ask for Russia’s gas price in its currency, the ruble. Whereas Germany has refused payment in Ruble and wants to pay in Euro as before. In this way, if Russia stops gas supply, then there is bound to be panic in Germany.

German Finance Minister Robert Hebeck has indicated a state of emergency will be imposed if the gas supply from Russia stops. The Finance Minister has requested the consumers to reduce the usage. Said that the people of Germany should save energy in view of the ongoing war in Ukraine. They reduce the use of gas and oil. The German government has hinted at reducing dependence on Russian gas. Poland will stop importing oil from Russia by the end of this year in compliance with sanctions imposed due to the Ukraine war.

Germany’s plans are cause for worry for environmentalists, as the emergency plans could complicate the country’s target to phase out coal by 2030 and jeopardise its overall energy transition goals. Germany recently accelerated the coal phase-out and is expecting to decommission almost as much lignite capacity in the next three years as it has in the last ten, but it is uncertain what effect the Ukraine war will have.

DISCLAIMER: The author is solely responsible for the views expressed in this article. The author carries the responsibility for citing and/or licensing of images utilized within the text.