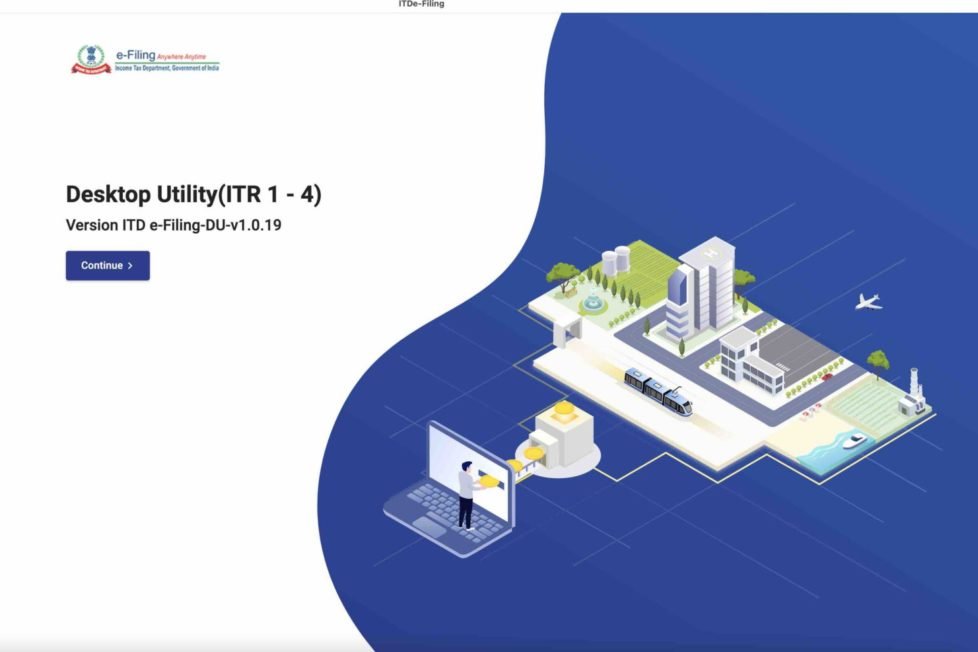

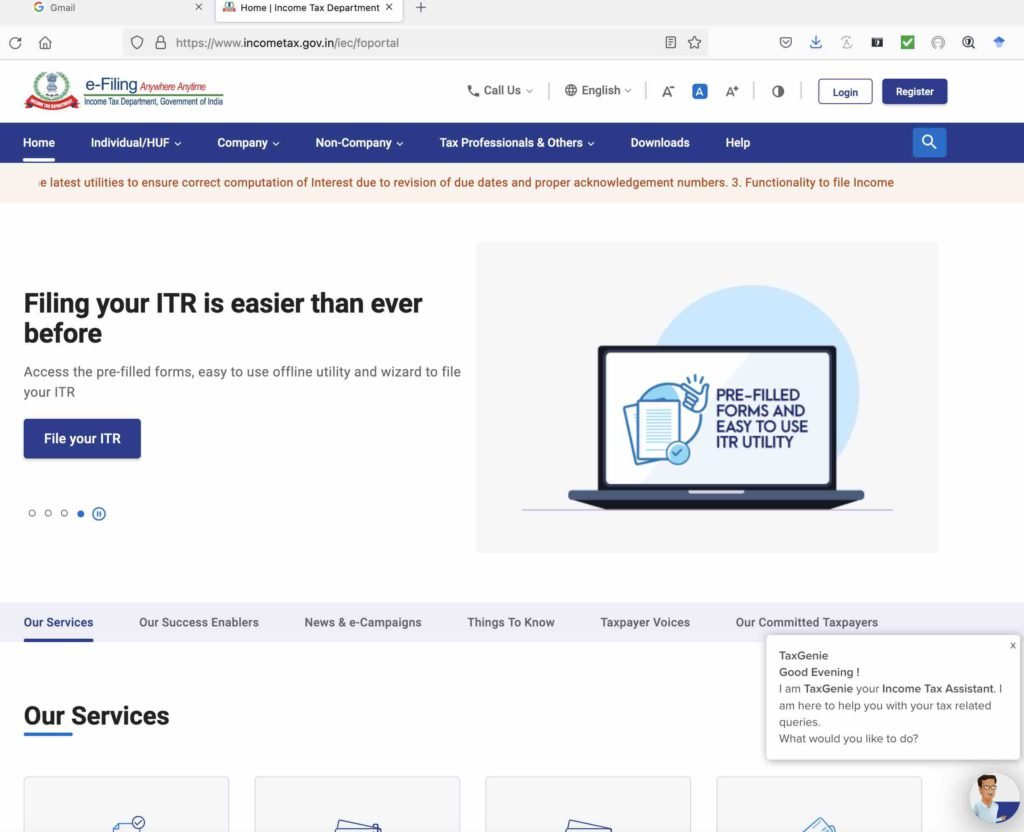

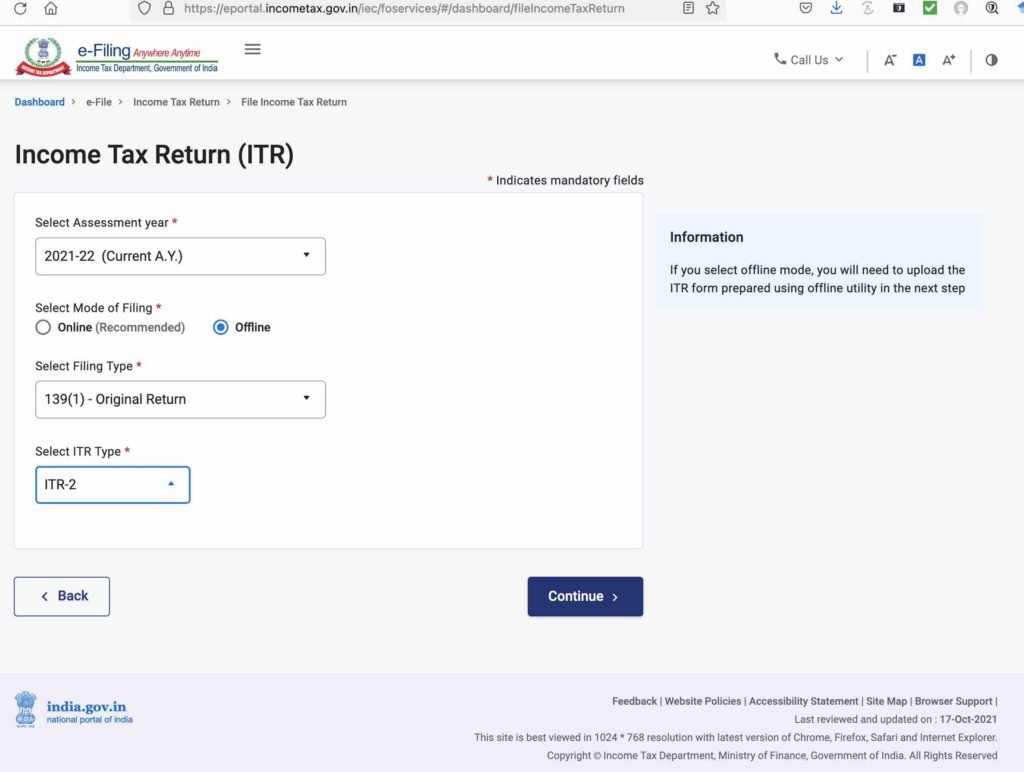

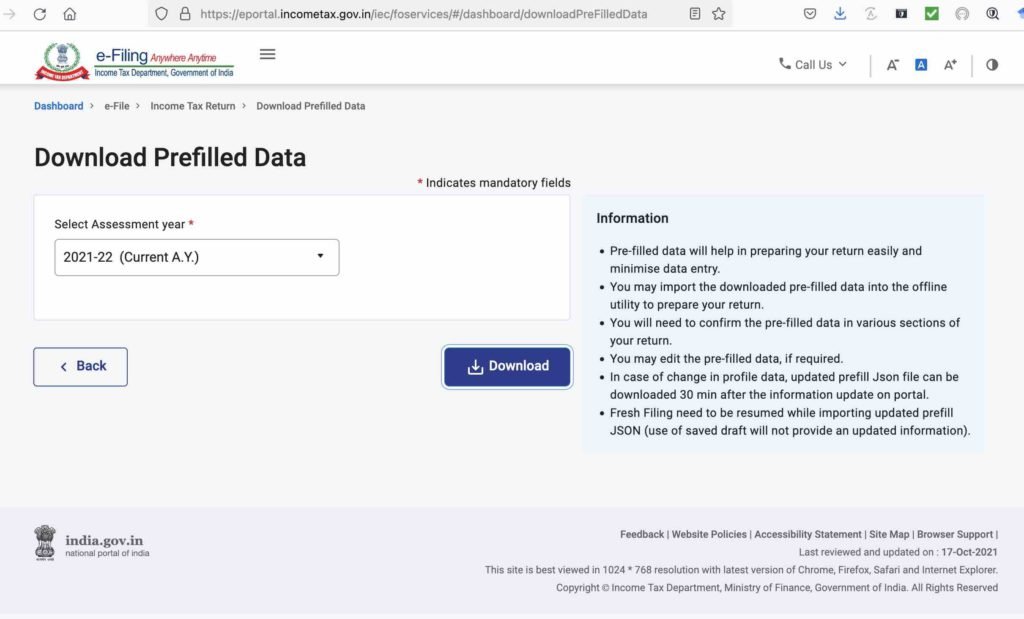

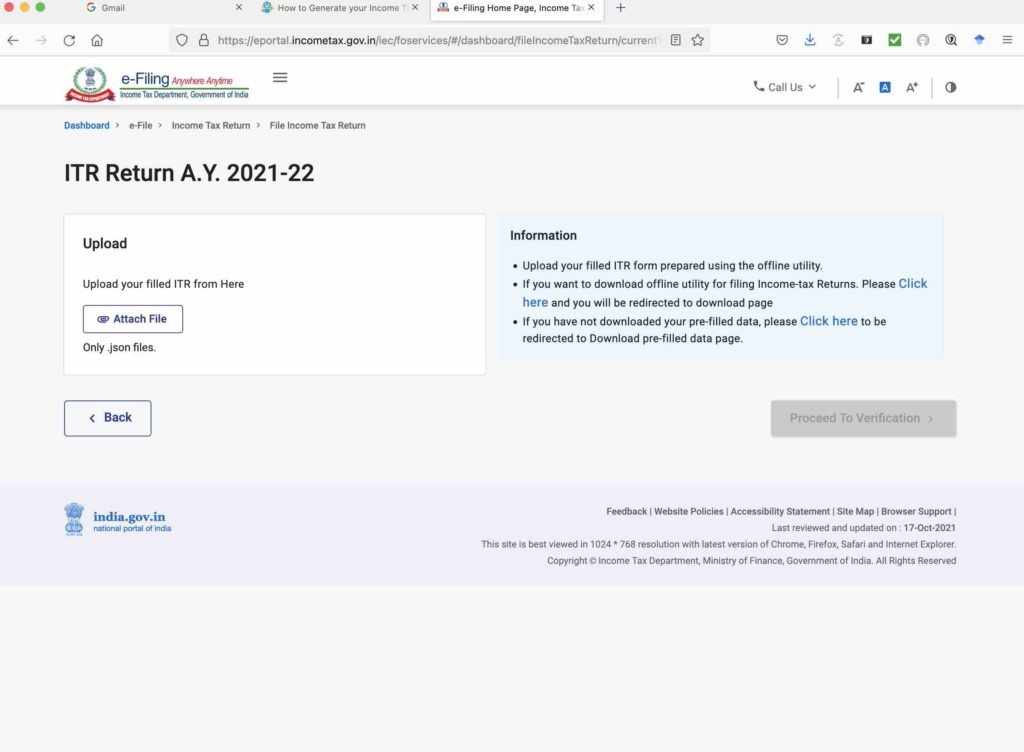

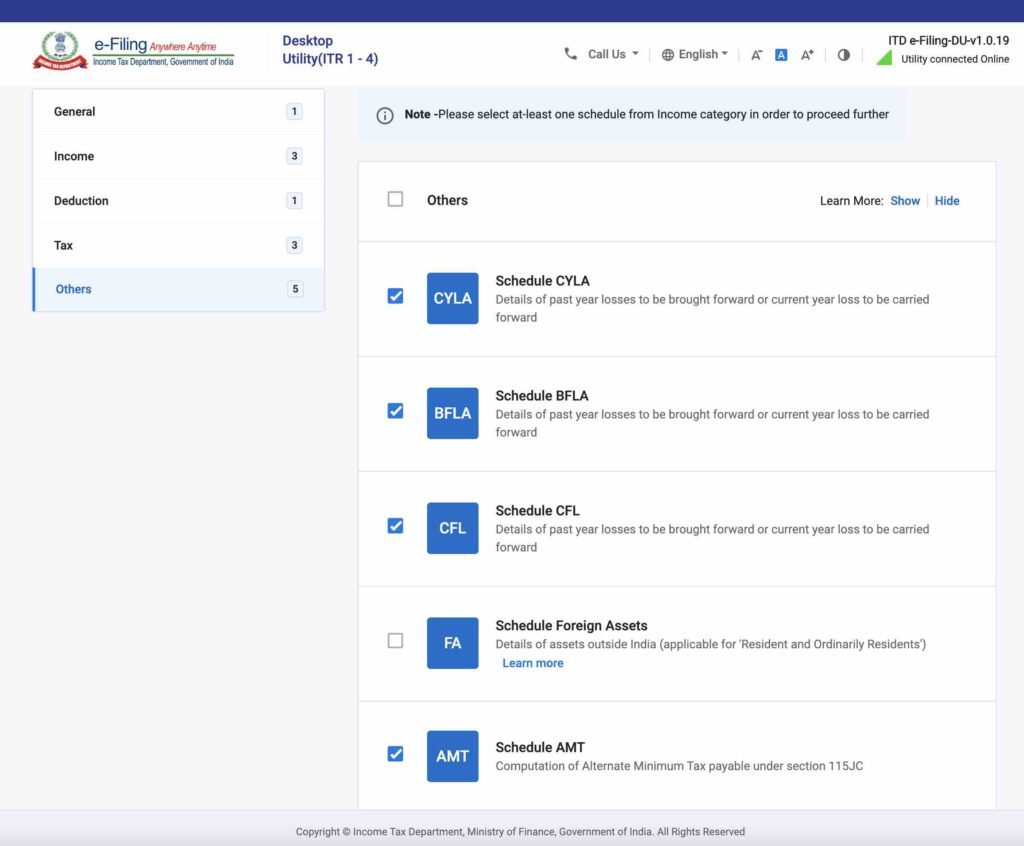

Using InfoSys Indian Income Tax Form ITR-2: Personal Experience October 2021

Swarajyamag called InfoSys: "India’s iconic software services company." Might "Maharajah of Indian Software" be more appropriate, a la Air India, given the current quality, functionality, maintenance and service. My request to InfoSys and the IT department: Please read what users are saying, please check your software and FIX it. Thanks.